Social entrepreneurs across the world are developing powerful business models for solving social problems

The greatest barrier which many face to scaling up their work is access to affordable finance. They need patient capital in the form of start-up loans and seed funding, as well as access to working capital lines of credit.

However many social entrepreneurs do not know how to access finance, even those who run viable and high impact social business models. Many entrepreneurs do not know how to develop the right business model that combines a commercial model with a social mission.

Social Finance Alliance for Romania (SoFiA)

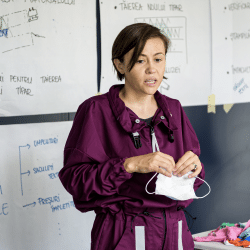

SoFiA is an integrated program seeking to act as a catalyser for the development of the social finance ecosystem in Romania. SoFiA provides tools and support for both the demand side and the supply side of social finance: 20 social enterprises will go through an investment readiness program with guidance from international and national mentors and, at the same time, private and public investors active in Romania will participate in social impact trainings. This integrated approach aims to create a community that will contribute to the creation of a social impact financial instrument in Romania.

Overall, the initiative targets developing the capacity of at least 60 stakeholders of the Romanian social finance market and designing and creating the conditions for launching at least one financial instrument for Romanian social enterprises. SoFiA was designed by an international partnership with complementary experience and competencies.

SoFiA will lay the foundations towards accelerating the social finance environment in a sustainable way. The results and learnings depicted from this effort will be translated into strategic ways of serving this main objective to ease access to finance.

Social enterprises

Support organisations

Potential public and private investors

Public institutions