Impact Finance Lab

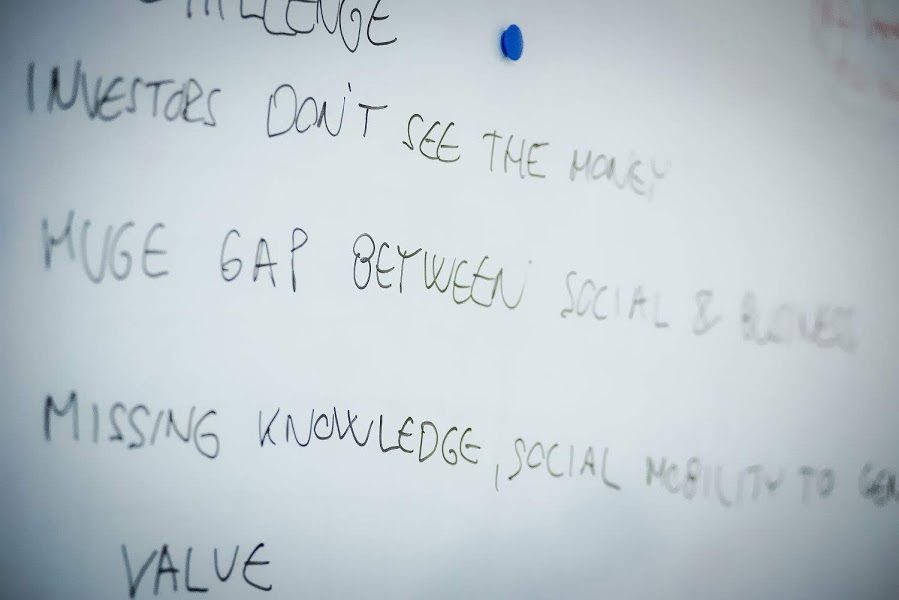

Impact Finance Lab - also called Social Finance Initiative - aiming to de-mystify the scene through more trust, know-how, and collaboration among the players. The pilot of Impact Finance Lab has successfully concluded in 2020, please check back for updates about the program.